Date: 2014-11-01

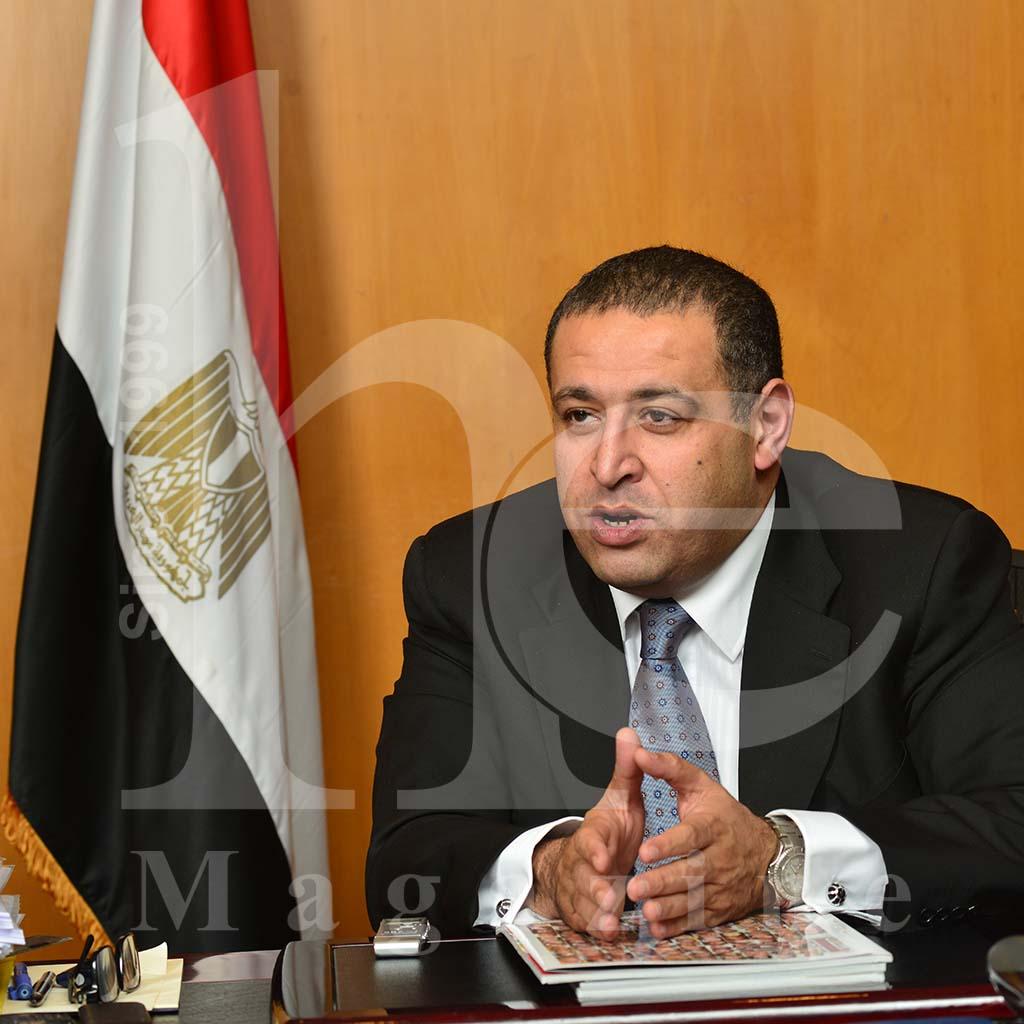

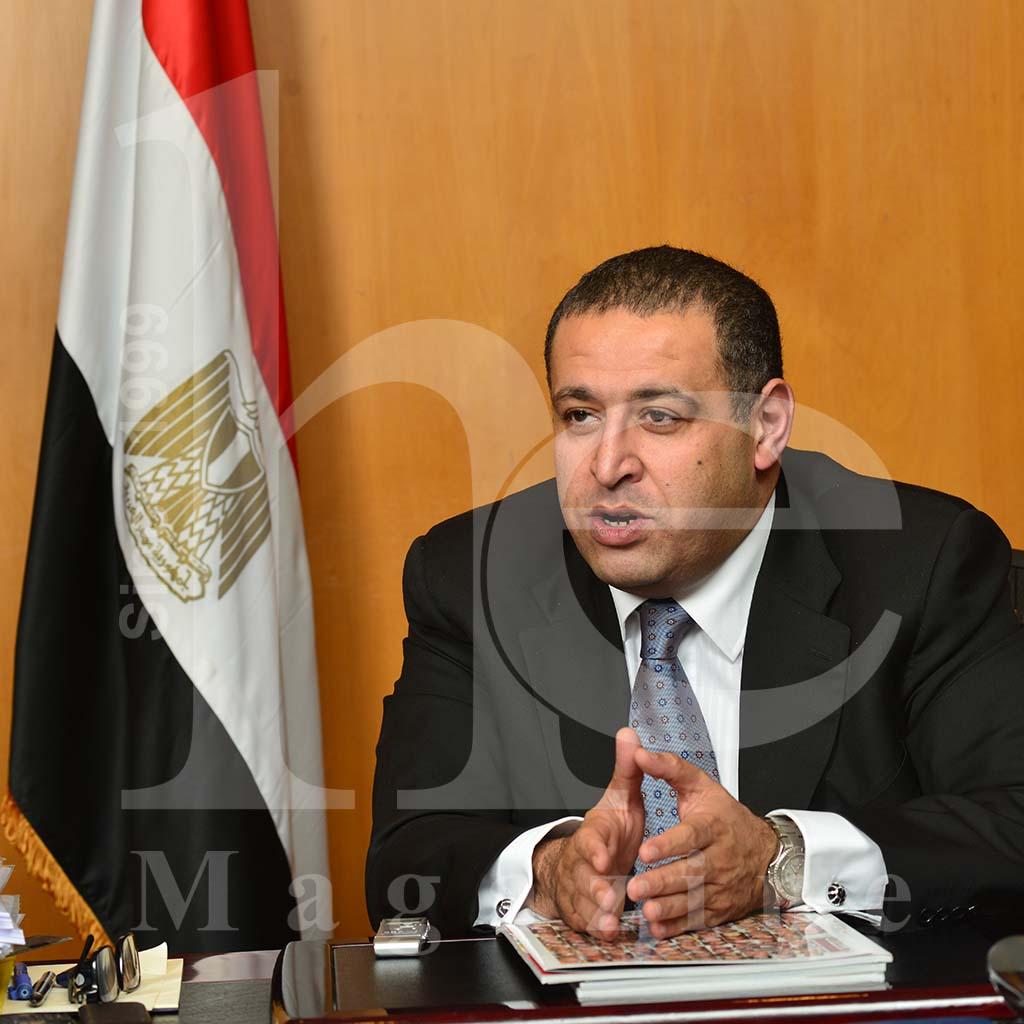

Exclusive Interview with H.E. Ashraf Salman, Minister of Investment

The appointment of Ashraf Salman as Minister of Investments signalled the Egyptian Government’s commitment to streamlining the investment environment and making it attractive to investors. Salman is young, dynamic and well versed in the intricacies of the Egyptian investment landscape. The few months since his appointment have seen wholehearted attempts at revamping, if not changing, some of Egypt’s investment legislations to make it more attractive to local and international investors.

he magazine sat down with the dynamic Minister Salman in an attempt to shed light on some of the recent changes.

Interview by: Amr Selim

What are some of the key legal impediments to investing in Egypt which you seek to change or add to the new investment law?

Two principal points need to be addressed:

Firstly,weall know that there are many bodies which have a mandate to be involved in the decision making process regarding allocation of land. Similarly, there are many entities with a mandate to issue licenses and business approvals. The number of these governmental bodies stands at 78. These entities are at different levels. The first are the line ministries, the second the governorates followed by civil defence and local authorities at the third level. Licenses and approvals are issued at all three levels. Naturally, the presence of these three layers represents a hindrance to any license issuance, approval or permit necessary for an investment project, be it commercial, industrial, agricultural, real estate or tourist related. These 78 bodies are involved in all of these sectors and represent a huge impediment within the current Egyptian investment law. We looked at case studies of countries which streamlined their investment laws and related approval processes and found that they now benefit from a significant share of direct investments and money inflow. Based on these international case studies, we have set out to streamline and simplify the one stop shop concept, which our predecessors had started. However, I need to point out that we need to be very strict about implementation of the one stop shop. It simply needs to be just one stop. It cannot be an additional stop over and above the 78 stops currently en route to licensing and approvals. A one stop shop means that only one entity is allowed to deal with investors; the other 78 bodies should not be allowed to deal with them.

This will lead us to the fact that when investors start to deal with only one stop, it does not mean that the 78 bodies will not be involved; they will be involved and will continue in their roles. However, they will have no direct interaction with investors whose only interface will be through the Investment Authority's one-stop-shop which will, in turn, be linked electronically to the other entities. The electronic linkage is designed to automate and, hence, shorten the approval process and minimize manual involvement. This will be the main change embodied in the amendment of Egypt's investment law. The law also needs to include certain guarantees such as non-discrimination between foreign, Arab or Egyptian investors.

The second point is repatriation: Repatriation is the guarantee given to investors that they will be able to transfer the dollars they invested in Egypt abroad at the time of exiting an investment. Repatriation of funds is a guarantee which must be inserted into Egypt's investment law together with some changes which our colleagues, entrusted with Free Zone regulations, have made significant strides in.

Dispute resolution is another area of the investment law which is being addressed. Dispute resolution committees need to derive their power from the rule of law. The rule of law will render committee decisions enforceable before administrative authorities.

Do these new laws and amendments necessitate approval by the yet to be elected Parliament?

No, all investment related changes are considered amendments which will be presented to the Board of Directors of the Investment Authority before being presented to the legislative committee formed by the President. The committee will, in turn, review the changes and draft them in legal terms. The committee will also decide on whether or not the changes necessitate a new law or whether they can be treated as changes. Whether it is called a new law or changes to the existing law won't make a difference in the final analysis. What matters is the resulting investment environment. How we get to a revised investment environment will be left up to legislators, some of which might believe that making changes is easier than re-drafting a new law clause by clause, whereas others might feel that the one-stop-shop and repatriation philosophies necessitate a new law. After discussions by legislators, the new law or changes will be presented to the President who will issue the law. Hence, we do not have to wait for Parliamentary elections.

The committee charged with reviewing the law is but one committee within the investment environment. There are numerous other committees including one for the Bankruptcy Law which means that the trade law will also need to be amended with regard to the Bankruptcy clause, which should include liquidation and withdrawal from the market. This necessitates amending some of the clauses relating to liquidation and market withdrawal. Amendments to the investment environment also touch upon some issues relating to the labour law; issues such as a balanced relationship between employer and workers. As part of creating an attractive investment environment, amendments to other laws remain a possibility. Laws protecting Egyptian products, metallurgy and industrial land are a few examples.

What are the goals of the Sharm El Sheikh Investment Summit? Do you think they will be met?

Firstly, I see the summit as a message to the world that since 30 June Egypt has begun tangible economic and political reform.

These reforms began with the three step political road map, the third step of which will be the upcoming parliamentary elections. In parallel, Egypt has made a full commitment to political and economic reform. Removal of subsidies, revision to the taxation system and embarking on large development projects demonstrate to the world that Egypt has taken concrete steps towards realising these reforms. Prominent advisors, The Lazard Group, have been chosen to plan the event and FWPP will be the event organisers for the Summit. We have chosen industry experts to plan our international conference.

Secondly, regarding projects, we will present investment banks with projects which could be of interest to them. Information will be made available on those projects which they deem to be appealing. As for projects which fall short of international expectations, we will fine tune them for presentation again. This will be orchestrated through Lazards.

What are your expectations, in terms of numbers, as to the investments that the summit will garner?

By way of example, a project such as Matrouh Airport City will not fall short of $3-4 billion. This project consists of a commercial area, an entertainment area and an airport logistics area, all constructed around the airport.

The summit will also host presentations of private sector projects in addition to governmental development projects. Some of the key project sectors are power generation, solar power, wind farms and using coal as an energy source. The summit will also include presentations of Public Private Partnership (PPP) projects in sectors such as water desalination. In total, the summit aims at attracting $15-20 billion in direct investments which is key to achieving the growth rates we have projected.

Are large scale projects in Sinai going to be showcased at the summit? Is Sinai on the Investment Authority's map at all?

Sinai is on the investment map and has been for a long time. Work is already underway on tourist as well as other areas in Sinai. The Summit will showcase a number of investments in Sharm El Sheikh and investment such as the Montazah land which will be home to a large scale project. Large scale investments in Marsa Alam and Hurghada are also on offer.

What about the Suez Canal Corridor? Do you have an investment target for it?

Investment size will become apparent once the project design has been finalized. We have a number of advisors working on submitting a master plan for the area. The master plan, which is to be presented in February, will divide areas around the corridor for specific investment purposes. Investment size required for areas around the corridor is expected to become clear in February.

What are the last developments in the African investment environment?

Naturally and by virtue of the Nile River, Africa is a very important trading partner for Egypt. Through its trade agreements with the African economic blocks, Egypt has the potential to position itself as the gateway to investing in Africa. We will begin with the COMESA then the SADEK followed by East Africa. The three economic blocks will, for the first time, hold their conference in Egypt at the beginning of December; the conference is expected to witness the announcement of their common market. It is worth noting that the three economic blocks include 26 African countries representing 58% of the African continent. As such we are honoured to host, attend and receive 26 African Presidents and Prime Ministers for a conference which will open a 620 million consumer market to us. The free trade agreements, as well as bilateral agreements, will also give us access to 1.6 billion consumers through factories producing in Egypt and selling Egyptian products. These agreements will enable Egypt to play a pivotal role as a gateway to investments in Africa and vice versa.

Does Egypt have competitors for the role it aspires to?

South Africa and Nigeria could represent competition. That said we've already started with East Africa.

What are the pull factors which, in your opinion, would attract investors to Egypt instead of the UAE or Jordan for example?

First:Egypt is strategically located at a crossroads which literally places it in the middle of the world. Egypt’s population of 90 million makes it a huge market. Add to that the access Egypt provides to neighbouring markets and access to markets with which Egypt has free trade agreements. In short, Egypt's strategic location coupled with its free trade agreements gives investors access to 1.6 billion consumers, which is a huge competitive advantage.

Second:Egypt is implementing a complete economic reform programme and is making headway towards achieving its economic growth targets. Egypt's quarterly results show GDP growth rising 6.8% over the same period last year. This is particularly impressive given the global economic slowdown.

Third: Egypt is enacting investment legislation which will result in an investment environment capable of competing with, amongst others, the UAE, Jordan, China and Singapore.

Fourth: Egypt has an underutilized economy with resources which are unmatched in any of these economies and, as such, utilization of these resources could result in a 100% return.

Fifth: cumulative return data for 2013-2014 show Egypt coming in second place behind Brazil with returns of up to 28-29%.

Therefore, Egypt boasts many pull factors capable of attracting foreign investments. It is worth noting that the Egyptian economy has a demonstrated ability for growth independent of foreign investments. It is also an extremely diversified economy hence reducing risks to investors. It is not an economy dependent on real estate or industry alone or on Suez Canal receipts, on tourism, education or agriculture alone. Diversified economies are less likely to collapse easily, with the biggest proof of that being the economy's weathering of the 2011-2013 period which was marked by a Revolution and its associated aftermath. The transitional period of electing a president saw Egypt’s economic growth hit 2.1% and rating agencies subsequently improved their outlook on Egypt from negative to stable, signalling that Egypt is on the right track to economic recovery.

Investors need a guarantee that investment legislations and amendments put in place are here to stay and are not subject to political change. Can you offer them that guarantee?

When Egyptians took to the streets in the Revolution, they did so in search of a stronger, better Egypt and to demonstrate that the people are the source of legislation. No matter how many times governments and leaders change, investments will always remain a priority. It will always be on the people's list of priorities.