Written by: Mahmoud Demerdash

Date: 2024-10-16

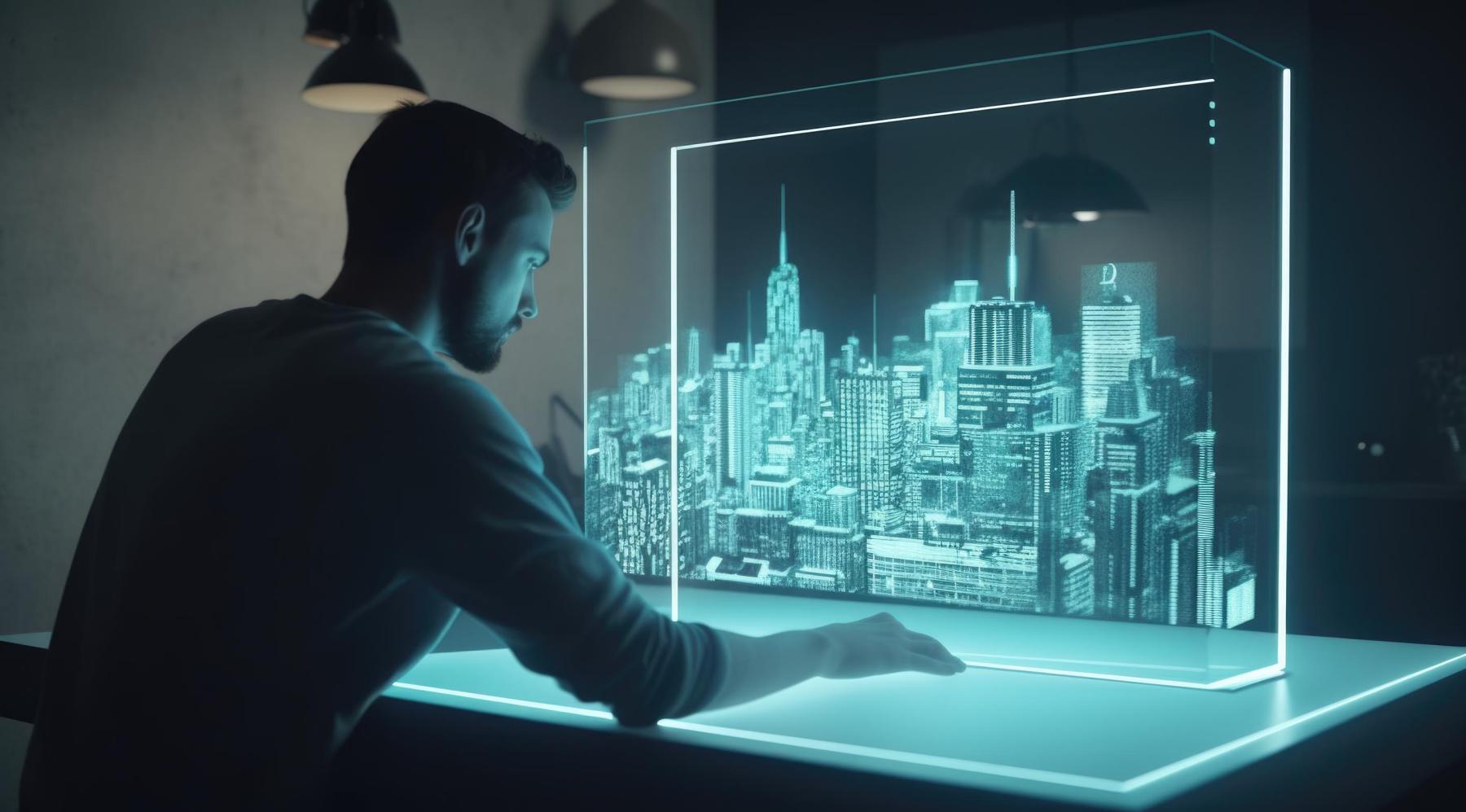

How technology is profoundly transforming the real estate industry

Technology has profoundly transformed the real estate industry, reshaping how properties are marketed, valued, and managed. More than just a tool, technology empowers real estate professionals, revolutionising every aspect of the industry. From the advent of virtual tours and augmented reality (AR) that offer immersive property experiences to AI-driven valuations that enhance accuracy and efficiency, these innovations are not just improving the convenience and precision of property transactions but also redefining the expectations and capabilities of real estate professionals. This exploration delves into how cutting-edge technologies influence the industry, highlighting their benefits, challenges, and the potential they hold for buyers and sellers.

Virtual tours and augmented reality (AR) have significantly transformed real estate marketing by providing immersive and interactive property experiences. Virtual tours allow potential buyers to explore properties remotely, enhancing marketing efforts by offering a realistic sense of space and layout. AR further elevates property visualisation, enabling clients to see how a space could look with different furniture or renovations. Numerous case studies have demonstrated the success of these technologies, indicating increased engagement, reduced time on the market, and improved decision-making for buyers and sellers alike.

AI-Driven Valuations

AI-driven property valuations change property appraisals by leveraging advanced algorithms to analyse vast data. These AI algorithms can assess market trends, property features, and historical sales more accurately and quickly than traditional methods. However, it's important to note that AI-driven valuations also come with potential risks and challenges. For instance, they may not always account for unique property features or local market conditions, leading to inaccurate valuations. The benefits of AI in property valuation include more precise pricing, reduced human error, and an objective approach to appraisals. As AI technology continues to evolve, it is expected to play an increasingly prominent role in real estate pricing, offering more reliable and efficient valuations in the future. Future developments in AI-driven valuations could include more sophisticated algorithms that can factor in a broader range of data points, leading to even more accurate valuations. Predictive analytics can analyse historical sales data, economic indicators, and demographic trends to forecast future real estate market conditions. For example, tools like “Zillow’s Zestimate” use predictive models to estimate future property values based on trends and historical data. Investors use predictive analytics to identify emerging neighbourhoods or markets with high potential for appreciation. Platforms like Mashvisor provide data-driven insights to help investors make informed decisions about where to invest based on predicted future property values and rental income potential. Real estate agents and brokers use predictive analytics to set competitive property pricing by analysing comparable sales, market trends, and buyer behaviour. For instance, Redfin's pricing algorithms consider recent sales data and market conditions to recommend pricing strategies for sellers. Predictive analytics helps assess the risk associated with real estate investments by evaluating market volatility, economic indicators, and property-specific data. Companies use predictive models to determine the risk of investment properties and provide detailed reports for investors. Real estate developers and property managers use predictive analytics to forecast property demand, such as residential, commercial, or rental. By analysing trends in rental rates, occupancy rates, and economic conditions, developers can make informed decisions about where and what to build.

Analysing Datasets

Big data and predictive analytics transform real estate by providing valuable insights that inform investment decisions. By analysing vast datasets, big data helps identify trends, forecast market movements, and assess property values more accurately. Predictive analytics leverages this data to project future market trends and property performance, enabling more informed decision-making. However, relying on data-driven insights comes with risks and challenges, such as potential inaccuracies, data quality issues, and over-reliance on algorithms. This leads to misguided decisions if not carefully managed. Tools like CoStar and REIS analyse vast amounts of real estate data, including property sales, rental rates, and market trends, to help investors identify high-performing markets and properties with the most significant potential for returns. Big data platforms such as Zillow and Redfin aggregate data on property transactions, neighbourhood trends, and economic indicators to provide insights on where to invest. These platforms analyse historical data and trends to predict future property values and rental income potential. Platforms like Roofstock use big data to offer comprehensive property analysis, including neighbourhood analytics, market trends, and financial performance metrics, helping investors make data-driven decisions about purchasing rental properties. Tools like HouseCanary and CoreLogic use predictive analytics to estimate future property values based on historical sales data, economic indicators, and market trends, providing accurate valuations and forecasts. Other platforms use predictive analytics to forecast housing market trends, including price movements, supply and demand dynamics, and buyer behaviour, helping real estate professionals and investors anticipate market changes. Services like Rentometer use predictive analytics to forecast future rental income based on historical rental data, neighbourhood trends, and property characteristics, aiding landlords and investors in setting competitive rental rates. However, it's crucial to consider the potential ethical issues related to predictive models and big data. For instance, predictive models can perpetuate existing biases if the underlying data reflects historical inequities or market biases. If a model is trained on data from predominantly affluent neighbourhoods, it might underestimate the potential of emerging or underserved areas. Collecting and analysing large amounts of data raises privacy concerns, especially when dealing with sensitive information about individuals and properties. Ensuring that data is used ethically and complies with privacy regulations is crucial.

IoT Devices

Integrating IoT (Internet of Things) devices is revolutionising modern homes, making them more connected and automated. Smart homes equipped with IoT devices IoT such as:

Smart Thermostats:

Example: Nest Learning Thermostat adjusts temperature based on user behaviour and seasons.

Smart Lighting Systems:

Example: Philips Hue allows remote lighting control and customisation through an app.

Smart Security Systems:

Example: Ring Video Doorbell provides real-time video feeds and integrates with other security devices.

Smart Locks:

Example: August Smart Lock enables keyless entry and remote locking via a smartphone app.

Smart Appliances:

Example: Samsung Smart Fridge tracks groceries, suggests recipes, and can be controlled remotely.

Smart Home Hubs:

Example: Amazon Echo and Google Nest Hub centralise control for various smart devices.

The prospect of a home that adjusts to your needs and preferences, even when you're not there, is not just convenient; it's thrilling. As smart home technology evolves, future trends indicate an increasing demand for these features. Integrating these advanced features enhances property appeal and intersects with other modern real estate practices. One such practice is using digital marketing strategies.

Digital Marketing Strategies

Digital marketing strategies are essential in modern real estate, with social media and online platforms playing a crucial role in property marketing. By leveraging these tools, real estate professionals can reach a broader audience and engage potential buyers more effectively. SEO and content marketing are critical in attracting buyers, ensuring that property listings rank high in search results and provide valuable information. Case studies on successful digital marketing campaigns highlight how these strategies can significantly boost visibility, drive engagement, and ultimately lead to faster and more profitable sales.

As digital marketing strategies enhance visibility and engagement in real estate, professionals must stay ahead by embracing ongoing training and education in these evolving technologies. While these tools revolutionise property marketing, balancing them with personal client interactions is critical to maintaining trust and relationships. Concurrently, virtual reality (VR) and 3D modelling transform architectural design and client presentations, offering immersive and detailed visualisations that improve planning and decision-making. Real estate professionals must adapt by pursuing ongoing training and education to stay current with new technologies as these tools become more integrated into the industry. However, despite the rise of digital tools, maintaining a balance between technology and the human touch remains crucial in client relationships, ensuring that personal connection and trust are preserved. Virtual reality (VR) and 3D modelling transform architectural design and client presentations by offering immersive, realistic experiences. VR allows architects and clients to explore and visualise spaces before they are built, enhancing planning and decision-making. 3D modelling benefits custom home designs by providing detailed and accurate representations of proposed structures. These technologies are increasingly used in real estate projects, enabling more effective communication between designers, clients, and builders and leading to better-informed decisions and more successful outcomes.

Ethical Considerations

The ethical considerations of AI and automation in real estate involve addressing potential biases in AI-driven property valuations, which can impact fairness and accuracy. Automation also affects jobs within the real estate sector, potentially displacing roles while creating new opportunities. AI algorithms can inherit biases present in historical data, leading to skewed property valuations. For example, an AI model trained on data from affluent neighbourhoods may undervalue properties in emerging or less wealthy areas, perpetuating existing inequalities. This includes using diverse datasets and incorporating feedback to adjust valuations. Automation can streamline tasks such as property management, market analysis, and customer service, potentially displacing traditional roles within the industry. For example, automated valuation models (AVMs) might reduce the need for human appraisers.

While some jobs may be displaced, automation creates new roles and opportunities, such as AI specialists, data analysts, and tech support positions. The challenge lies in managing the transition for affected workers. Implementing measures to prevent and mitigate bias is crucial. This includes regularly auditing AI systems for fairness, updating algorithms to reflect current data, and involving diverse teams in developing and monitoring AI technologies. While automation can enhance efficiency and reduce operational costs, ensuring these benefits do not come at the expense of fairness is essential. Real estate professionals and tech developers must collaborate to create solutions that balance efficiency with ethical considerations, promoting transparency and accountability. Organisations must also focus on maintaining job security and ethical practices. This involves supporting employees through transitions, investing in skill development, and ensuring technological advancements benefit the industry and its workforce. Ensuring that AI-driven valuations are fair and accurate involves scrutinising the data used to train these models and continuously refining algorithms to address potential biases. This requires careful consideration of the ethical use of technology, implementing safeguards to prevent bias, and promoting practices that balance efficiency with fairness and job security.